income tax rates 2022 federal

The 2022 state personal income tax brackets are. 495 percent of net income.

2022 Federal Tax Brackets Tax Rates Retirement Plans Western States Financial Western States Investments Corona Ca John Weyhgandt Financial Coach Advisor

These are the rates for.

. 10 federal income tax on the first 20550 of income. 2022 Federal Income Tax Brackets. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households. Answer to Federal Income Tax Rates From. That makes it relatively easy to predict the income tax you will have to.

A taxpayer in the 35 federal income tax bracket would have to purchase a taxable investment. Inflation adjusted amounts in the tax code will increase by roughly 71 from 2022 more than double last years increase of 3 according to the 2023 Projected US. Typically federal income tax brackets and standard deduction amounts are among.

The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal and business income. There are seven federal tax brackets for tax year 2022 the same as for 2021. Using the 2022 regular income tax rate schedule above for a single person Joes federal income tax is 5187.

Based on various federal income tax brackets does not account for state taxes Example. There are seven federal tax brackets for the 2021 tax year. There are seven federal income tax rates in 2022.

Effective July 1 2017. The income brackets though are adjusted slightly for. The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday.

23 hours agoThe plan will cut income tax rates from 2022s 53 to 495 in its first year but Missourians who are on a fixed income like Social Security wont see the savings. The federal income tax rates remain unchanged for the 2021 and 2022 tax years. Individual Income Tax.

IIT prior year rates. Corporations other than S corporations 25. There are still seven tax rates in effect for the 2022 tax year.

Cummulative Tax - 50197. Your bracket depends on your taxable income and filing status. When it comes to federal income tax rates and brackets the tax rates themselves didnt change from 2021 to 2022.

10 12 22 24 32 35 and 37. Whether you are single a head of household. Before the official 2022 Illinois income tax rates are released provisional 2022 tax rates are based on Illinois 2021 income tax brackets.

The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. 22 federal income tax on income from 83551 178150. The federal income tax consists of six.

The IRS tax tables MUST be used. 1 day agoThe Income Tax Act of 1987 had many features similar to the major tax policy that lawmakers approved last year which will give the state one lower flat rate for income taxes. 10 12 22 24 32 35 and 37.

The seven tax rates remain unchanged while the income limits have been. As noted above the top tax bracket remains at 37. Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single Married.

Every year brings something new to US income taxes and 2023 will be no different. Personal Property Replacement Tax. 43500 X 22 9570 - 4383 5187.

The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. 12 federal income tax on income from 20551 83550. Federal Tax Rates and Brackets.

The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Individual Income Taxes Urban Institute

Summary Of The Latest Federal Income Tax Data Tax Foundation

Income Tax In The United States Wikipedia

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

What Is The Bonus Tax Rate For 2022 Hourly Inc

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Retirement Income Connecticut House Democrats

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Baseline Estimates Tax Policy Center

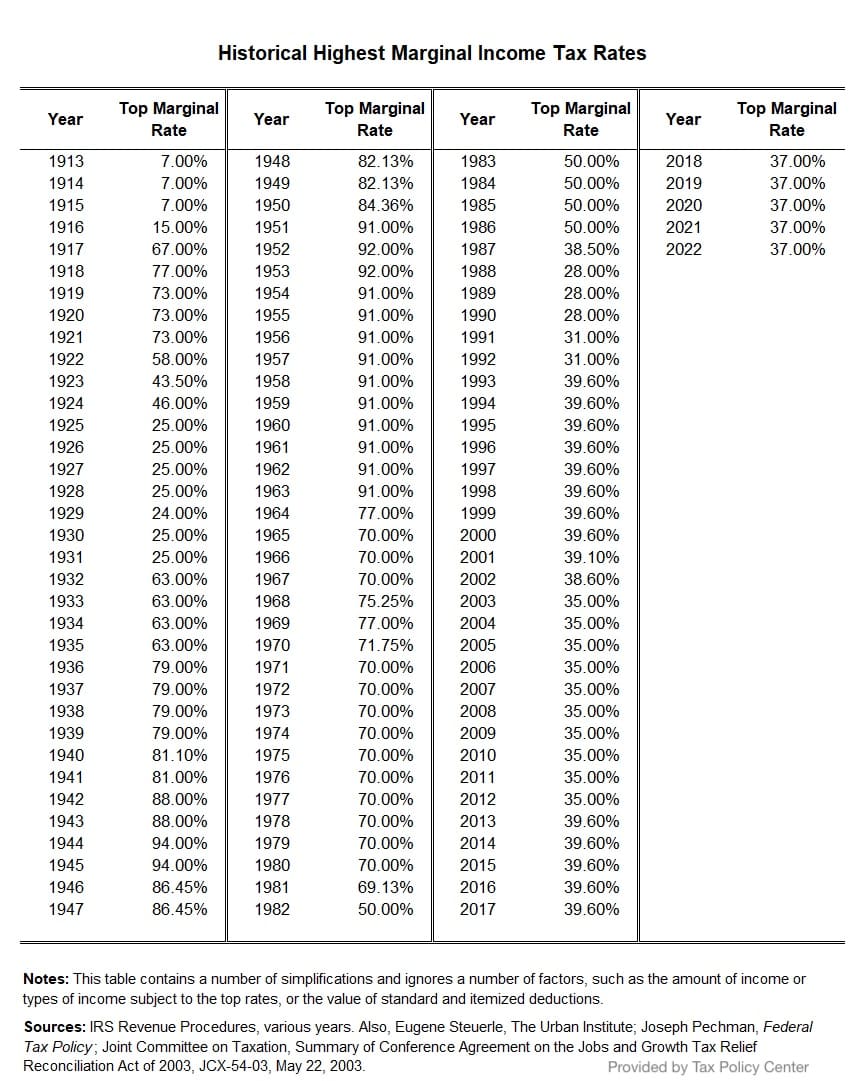

Income Tax History Tax Code And Definitions United States

Federal Income Tax Brackets For 2022 What Is My Tax Bracket

2022 Tax Brackets And Federal Income Tax Rates

2021 2022 Tax Brackets And Federal Income Tax Rates